Undergraduate Resources Hub

Everything you need to make smarter decisions about paying for undergraduate school. Explore tools, guides, and expert insights on loans, rates, repayment, and key policy changes.

Most Popular Resources

New Federal Loan Rules

Federal loan programs are being limited for new undergraduate students. Learn how these changes may impact your funding options and costs.

Learn more

The Complete Undergraduate Loan Guide

A comprehensive guide to undergraduate loans, covering costs, credit basics, interest rates, and how to choose a lender.

Learn more

Private vs Federal PLUS Loan Comparison Tool

See how Parent PLUS loans stack up against private options to find the most affordable way to fund college.

Access Now

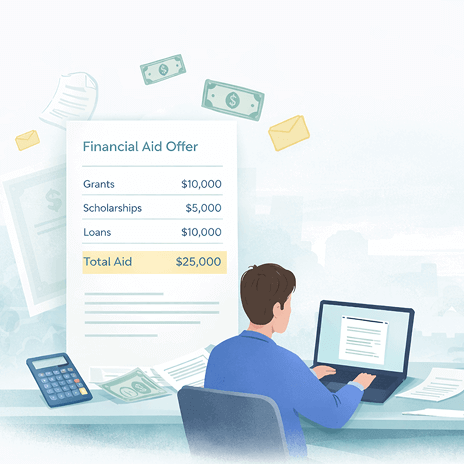

Financial Aid Appeal Generator

Get the financial aid you deserve. Our tool helps you write a compelling appeal letter in minutes, so you can focus on your education, not your finances.

Write your appealExpert Undergraduate Loan Insights

On-demand content, including articles, webinars, and FAQs, to help you navigate Undergraduate financing with confidence.

Undergraduate Loan Frequently Asked Questions

Expert answers to common undergraduate loan questions, all in one place.

Does Juno replace federal aid?

Can parents refinance Parent PLUS loans through Juno?

Are rates higher than for grad students?

Is a parent cosigner required?

Does Juno work with undergraduate students?

Is there any cost to join Juno?

Don't see your question here?

If you have any questions, feel free to contact us.

Schedule a free consultation