Top 8 Most Popular Questions

1. When do I start?

Usually a month before the tuition billing due date. If the student is starting in the fall, July is a common month to apply. You can apply as soon as your school is able to certify the loan amount though.

2. How long does it take?

Usually a few weeks from start to finish. You can usually get initial quotes pretty quickly (within a few days) and decide what to do from there.

3. Where does the money go?

The lender sends the loan to the school. If you are taking out funds to cover living expenses (like an apartment), the school will send anything beyond their costs to the student.

4. What do most families do in terms of loans?

They hit the Federal Direct cap first. Depends on the student but starts at $5,500. Then if they need more they decide between federal Parent PLUS and private student loans. For those with good credit scores, private loans tend to be cheaper.

5. What kind of private loan do they take out?

The most common are fixed interest 10 year loans. Many don't want to pay anything while in school (deferred) but the smarter strategy is often to pay a little while in school to get a lower interest rate. If you pay $25 every month for example it can result in significant savings, especially when you use the autopay discount.

6. Can I pay off the loan early?

Yes. There are no penalties or fees associated with this. In fact, there are no fees at all.

7. Does it matter if my student doesn't have a credit score?

Usually the student's credit score doesn't matter if the parent is cosigning (the most common situation).

8. How much can I take out?

Up to the school's stated cost of attendance minus any financial aid received.

What is a Student Loan?

A student loan is when you or your guardian borrows money in order to pay for college. You can take out student loans for a number of reasons, and apply them to many different degree programs.

When a student loan is taken out, it’s usually only for one year of attendance. Most federal loans are disbursed per semester within an academic year. If you're borrowing for the academic year 2024-2025, you would likely get one installment at the beginning of fall semester 2024, and then another installment at the beginning of spring semester 2025.

You don’t need to stick with the same student loan provider for 4 years. You can borrow only federal loans one year, and then borrow from Sallie Mae, for example, the next year.

Federal Loans

For grad students, professional students, and parents of dependent undergrads. These are loans offered by the federal government.

Direct Subsidized Loan

aka Stafford Loans

For eligible undergraduates who demonstrate financial need. Usually the cheapest option available for undergraduate students. The interest you owe doesn’t begin accruing until 6 months after graduation, which is also how long you have before you need to start paying back the loan (known as the grace period).

Direct Unsubsidized Loan

aka Stafford Loans

For eligible undergraduates and graduate students but eligibility is not based on financial need. You also have a 6 month grace period but interest begins accruing immediately after these loans are disbursed.

Direct PLUS Loan

For grad students, professional students, and parents of dependent undergrads. Eligibility is not based on financial need, but a credit check is required. Interest rates may be higher on these loans, but you are able to borrow the entire cost of attendance. The current rate is 8.94%, plus a 4.2% origination fee.

Private Loans

For grad students, professional students, and parents of dependent undergrads.

These are loans offered by Juno partners.

Different Loans What They Mean

Stafford Loans

Direct loans to students from the government

Unsubsidized

- 6 month grace period from making payments after graduation

- Begin accruing interest immediately

- No requirement to demonstrate financial need

- Undergraduate AND graduate students are eligible

Subsidized

- 6 month grace period from making payments after graduation

- You only pay interest that begins accruing 6 months after graduation

- Requirement to demonstrate financial need

- Only undergraduate students are eligible

PLUS Loans:

Also via Government

- Taken out by a parent for an undergraduate student

- Interest is higher than Direct loans

- May borrow up to $20,000 per student per year, with a lifetime limit of $65,000 per student

- No requirement to demonstrate financial need

Private Loans:

Via Juno and Others

- 3rd party loan, not connected to the government

- Interest can be lower than federal student loans

- Income and credit qualifications are often stricter

- Do not include financial hardship guarantees or forgiveness opportunities

Federal Loans

Advantages

Advantages

- Easier to get

- Provides some "insurance" like Income Driven Repayment Programs and Public Service Loan Forgiveness in case you have a low paying job later

- Potentially lower interest rate which often results in lower monthly interest rates and lower total money paid over the life of the loan

- Especially advantageous for those in higher paying jobs that will likely not benefit from federal protections

Disadvantages

Disadvantages

Private Loans

- Potentially higher interest rate

- You may never qualify for federal loan protections and end up paying significantly more money over the life of your loan

- Fewer protections than federal loan, no loan forgiveness

- Not everyone can qualify -- it depends on your credit score and financial situation

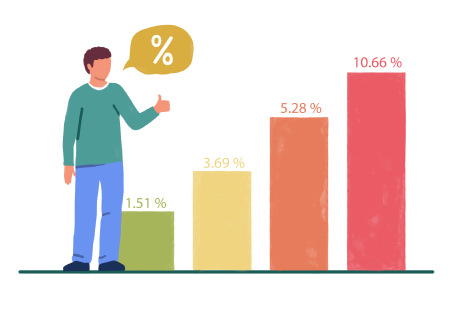

What is an Interest Rate?

An interest rate is best understood as the cost of borrowing a certain amount of money. When you take out a student loan or any loan, it will come with this cost. People normally look to get loans that have the lowest interest rates (keeping in mind any associated fees that add to the total cost).

Some loans don’t begin charging interest until a certain time after you graduate, some start charging interest immediately. Interest is expressed as a percentage of the total loan amount. If you took out a $5,000 loan, and your interest was 10% fixed a year, that would mean that every year, $500 would be added to your original loan of $5,000 (assuming you only paid off the interest each year).

While seemingly insignificant, the difference between a 10% and 5% fixed interest rate in the example above could mean more than $250 in savings each year.

Fixed-Rate:

As the example above shows, a fixed rate will stay the same throughout the entire life of your loan

Variable Rate:

A variable rate is when an interest rate fluctuates through the repayment process. These interest rates rise and fall with something called SOFR, which “influential interest rate that banks use to price U.S. dollar-denominated derivatives and loans."

A quick note: Federal loans only offer fixed rates while private lenders usually offer both. Variable rates for private loans are usually lower than fixed rates, but they can go up and down over time.

Fees?

Applying for loans can come with fees. Here are a few common ones you may run into.

Origination Fee:

A fee charged by a lender when you first take out a loan. The federal government is charging a 4.228% origination fee for Parent/Grad PLUS loans this year. Juno’s partner has no origination fee. That might mean the difference between several thousand dollars depending on the amount you borrow.

Prepayment Penalty:

A fee if you pay back your loan ahead of the predetermined schedule. When you graduate, you become a lower credit risk and may be able to refinance your loans at a lower cost. Make sure your loan has no prepayment penalty, so you can refinance with ease. Very few lenders use this. Avoid it whenever possible.

Application Fee:

These are pretty rare. Federal loan applications don’t have application fees, and most private lenders don’t either. If you come across a private lender with an application fee, it’s a red flag, so look closely at your loan terms.

The Basics of Paying for School

Your COA (Cost of Attendance) is estimated by universities using these factors:

Tuition + Mandatory fees for course materials, Room & Board, Health Insurance, Personal Expenses

Schools include multiple estimates for singles, couples, and families. If you aren’t living on campus, already have health insurance, or have scholarships, you may not pay the full COA, as you won’t incur the full cost of the items listed. Keep this in mind when researching schools, and when making other decisions, like if you should move on-campus, get an apartment, or stay at home.

It’s likely you’re going to be applying for financial aid in order to save money on the tuition portion of the COA. There are many different kinds of financial aid, and categories vary between universities. You will typically hear about merit-based aid as soon as you’re admitted. Most schools will have you apply for need-based financial aid after you’ve been admitted and accepted their offer. It’s within merit-based aid that most people are awarded things like scholarships or gift-aid by the school. Need-based aid will be based on separate applications, like FAFSA, or the university’s own need-based financial aid form. It typically takes 3-4 weeks to hear back about need-based aid.

Once you hear back from your university’s aid office, you’ll be presented with an award letter. Think of your financial aid award letter as a first draft as opposed to a finished product. If you really want to go somewhere and the cost after scholarships and aid is too high, try asking for more. Schools won’t rescind your acceptance just because you ask politely for more financial help, so try! Check out our template for negotiating more financial aid here.

A few tips when asking for more aid:

- Be selective about asking. Make sure you really want to go to that program.

- It usually helps if you’ve gotten into more than one school and can credibly tell one school that you’d choose it if you had more aid.

- You’ve already been accepted. They won’t change their minds because you ask for some help politely. So make sure to ask.

Now that that’s out of the way, we can talk about the next step, which is taking out loans to cover what scholarships, merit-aid, and need-based aid won’t cover.

Undergraduates have options when it comes to borrowing student loans. You can take out a federal student loan or a private student loan, you can also choose between taking out a loan in your name or if you have the option, having your parents take a loan for you, through a Parent Plus Loan, or a private student loan with your guardian as a co-signer.

When deciding between federal versus private student loans, there are a few things to consider. Federal Stafford loans will likely have the lowest interest rates but it’s common that students need to borrow more than that federal limit. The federal borrowing limit for dependent undergraduates is usually around $5,500 for the first year.

However, undergraduates who display exceptional financial needs may be eligible for a Pell Grant from the federal government. You should apply to FAFSA, which determines your eligibility for things like additional grants and work-study. Both public and private colleges use FAFSA to gauge your financial situation; applying is a great way to make sure you get access to the aid you are eligible for and don’t end up over-borrowing.

After you’ve applied to FAFSA, figured out your Pell-Grant eligibility, and borrowed to the federal cap, that’s where private loans come in. Private loans are best used for the remainder of financial need and can be used in lieu of a Parent PLUS loan (8.94% with a 4.228% origination fee) which can be more expensive than a private loan. Popular places to borrow private loans include Sallie Mae, College Ave, and Discover (Juno helps you get discounts from lenders like these).

If you’re a DACA student, financing an education may be tricky, but not impossible. Check out our DACA-specific guide here.

After you’ve borrowed and your loan has been dispersed, we highly recommend remaining organized from the get-go. That means organizing your loans even before you graduate, and knowing when your payback period starts, what kind of loans you’ve taken out, and where they’re held. That way, you won’t be blindsided by payments after your grace period.

Refinancing: The Low Down

What do you do after graduating? Well, you start having to pay back your loans. However, there is a way to save money through this process too, and that's refinancing. Refinancing basically means to finance (something) again, typically by taking out a new loan at a lower interest rate. The new, cheaper loan, pays off the old loan, and you save on the overall loan cost while likely lowering your monthly payment.

When you first take out a loan, the interest rate is set by a variety of factors including your ‘riskiness’ – the likelihood you’ll pay it back. Once you have a steady income, your ‘risk’ is reduced and lenders are more willing to give you a better deal. Refinancing usually works best for graduates who have Unsubsidized Direct Loans, Graduate PLUS loans, and/or private loans. Refinancing federal loans may forfeit certain perks such as public service forgiveness and economic hardship programs.

It’s important to keep in mind what your career plans are and how those may affect your federal loans. If you are going into public service, you may want to keep your federal loans so that you may qualify for Public Service Loan Forgiveness.

We’re here to help!

You can email us at hello@joinjuno.com or call us at (339) 330-4147 with any questions