A Guide to Upcoming Federal Loan Changes

New legislation in 2025, including the H.R. 1, 119th Congress, 2025–2026 (aka OBBBA), are bringing many changes to federal student loan programs. Here’s a summary of what’s changing in various categories.

General Changes (Applying To Most Or All Federal Loan Borrowers):

Loan Limits:

Total Loan Limit:

Student loan borrowers will now have a lifetime federal loan borrowing limit (also known as an 'aggregate limit') of $257,000 between undergraduate and graduate loans. Parent PLUS loans are not considered in this calculation but have separate and distinct changes to the limits.

Institution-Based Loan Limits Changes:

Institutions now have the ability to further limit the total amount in loans a student and parent can borrow for an academic year, as long as it applies consistently to all students enrolled in the program of study.

Part-Time Borrowers:

For part-time students, borrowers will have their annual loan amount reduced proportionally based on their enrollment intensity. Regulations defining prorations are still being finalized. Previously, loan limits were only impacted if students attended less than a full academic year (e.g. graduating a semester earlier).

Ineligibility for Federal Aid:

College degree and certificate programs will not be eligible for federal aid if graduate earnings fall below those of high school graduates for 2-3 consecutive years.

Institutions are required to inform the students enrolled in the education program if graduate earnings fall below for at least one year.

Repayment Plans:

If you ENROLL in one of these repayment plans BEFORE July 2028 (Graduated, Extended, IBR):

You will be able to remain in these plans as long as you don’t borrow a new federal student loan after July 1, 2026. Additionally, for borrowers enrolling in Income-Based Repayment (IBR), you will have to ensure that you meet recertification deadlines to remain in IBR.

If you ENROLL in one of these repayment plans BEFORE July 1st, 2027 (SAVE, ICR, or PAYE):

New enrollments in SAVE are not being accepted by the Department of Education. Please see the note below for existing SAVE borrowers.

You can continue to enroll in PAYE or ICR until July 2027. After that time, you will have the option to enroll in IBR or the newly added Repayment Assistance Plan (RAP) until July 2028.

Borrowers who don’t voluntarily enroll in IBR will automatically be placed on the RAP plan.

Note for current SAVE Borrowers: As of August 1st, 2025, borrowers enrolled in the SAVE plan still have their loans in forbearance, but interest started accruing again. You can make voluntary payments, which will first be credited toward the outstanding interest balance for your loan. These payments will not count towards PSLF or IDR forgiveness. Borrowers wanting to count time in the SAVE forbearance towards PSLF may explore the PSLF buyback option.

How did the Income-Based Repayment (IBR) Plan change?

No partial financial hardship requirement

- IBR is capped at the 10 year standard plan payment for your loans. If you enroll in IBR but your income level would make your payments higher than a 10 year standard plan, then your payments would be capped at the 10 year standard plan amount.

Parent PLUS borrowers are potentially eligible for IBR now, if they meet the following requirements:

- Borrowers should be eligible for IBR if they consolidate their loans and the consolidation is fully processed prior to July 1st, 2026

- After consolidation, they must enroll under the Income-Contingent Repayment (ICR Plan) directly before IBR

- They must make one full payment under ICR

Previous payment terms and monthly payment calculations remain the same, depending on the year you borrowed your loan. As a recap, these are the conditions:

- Borrowers before July 1st, 2014: 15% of discretionary income, 25-year loan term

- Borrowers on or after July 1st, 2014 (with no existing federal loan balance): 10% of discretionary income, 20-year loan term

If you borrowed a federal student loan prior to July 1st, 2014 but paid that loan off in full, then you would be considered a new borrower and eligible for the version that accounts for 10% of discretionary income and a 20-year loan term.

New Plans or Changes

These will be the only options for borrowers who receive their first loan after June 30th, 2026. Borrowers prior to that will also have access to these options.

Standard Repayment Plan

This plan is fixed monthly payments based on the total outstanding principle of the loan. The primary change is that the term length now varies based on total balance.

<$25,000

10 years

<$50,000

15 years

<$100,000

20 years

More than $100,000

25 years

Previously, under the standard plan, the repayment length was only adjusted for consolidated loans.

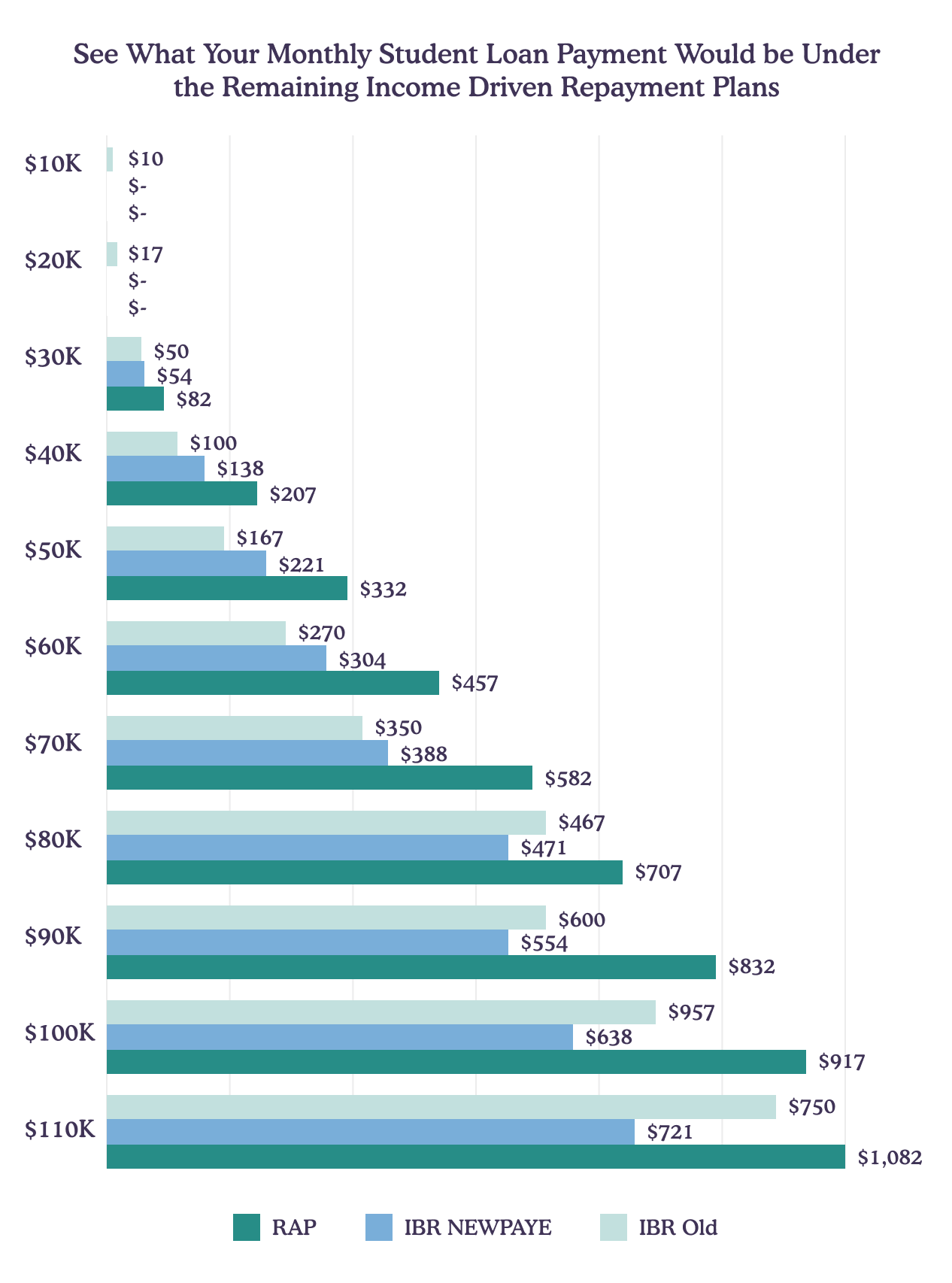

Repayment Assistance Plan (RAP)

The Repayment Assistance Plan (RAP) is a new income-driven plan being introduced effective July 1, 2026. It requires 1-10% of a person's monthly adjusted gross income (vs discretionary income for IBR and other income driven plans), dependent on how much money someone makes.

This plan requires at least a $10 minimum monthly payment, and 30 years of payments are required for forgiveness. Payments qualify for PSLF.

What's the difference between discretionary and adjusted gross income?

Adjusted gross income is your total income after tax adjustments. Discretionary income (factored in other IDRs) is adjusted gross income minus a poverty guideline for your family size and state of residence.

The plan also has two additional benefits:

- Interest Subsidy – If the monthly payment doesn't cover the accrued interest, the unpaid interest for that month is not charged to the borrower.

- Principal Reduction – If the RAP payment reduces the principal balance by less than $50, the balance is guaranteed to be further reduced by an amount that brings the total reduction to $50 per monthly payment.

This plan may have higher monthly payments compared to other IDR plans because this plan has no payment cap based on income over time. Also of note, Parent PLUS borrowers will not be eligible for this plan.

I have a Parent PLUS Loan! Is there any way I can keep an income-driven repayment (IDR) plan?

You must consolidate your loans before July 1st, 2026. You will have to apply for the ICR plan, make at least one payment on the ICR plan, and then apply for IBR. If you consolidate your loans or borrow a new Parent PLUS Loan after this date, you will not be eligible for income-driven repayment plans.

PSLF Changes:

The current eligibility and term requirements for PSLF are not impacted by the BBB. New borrowers remain eligible to enroll, except for new Parent PLUS borrowers after July 1st, 2026 (since they will not be eligible for IDR plans).

Unemployment or Economic Hardship Deferment and Forbearance:

Currently:

Deferment is one of the key benefits of federal loans. It allows you to postpone payments on all loans - and interest accrual on Direct Subsidized Loans - for a temporary period due to unemployment or economic hardship.

General forbearance is a process where you can pause the requirement for monthly payments, but interest will still accrue. This has typically been used for general reasons such as medical expenses or financial hardship that were otherwise not accepted under deferment.

Changes:

Unemployment and Economic Hardship Deferment will be sunsetted entirely for loans disbursed after July 1st, 2027.

Previously, forbearance could not be granted for more than 12 months at time, but you could request another period. Servicers had the ability to limit it to three (3) years maximum. Under the new rules, there is a cap of nine (9) months for any rolling 24-month period borrowers who have a loan disbursed after July 1st, 2027.

Even if you are otherwise grandfathered into the old limits, any loan disbursed on or after July 1, 2027, will be subject to the new limitations. This restriction is tied to the loan's disbursement date, not the borrower's enrollment period or loan request date.

💡 Remaining Question:

Consolidating your loans after July 1, 2027, may also affect eligibility for deferment and forbearance. The law applies the new rules to "a loan made on or after July 1, 2027," which could include consolidation loans. However, it is not yet clear whether consolidation would reset the disbursement date for all underlying loans. Guidance on this point will be issued at a later date.

Loan Rehabilitation

Loan rehabilitation is a process where a borrower could make an agreement with their servicer to remove the defaulting status from their loan after a specified number of on-time payments. Previously, a borrower could only do this once, but the limit has been raised to twice per lifetime. This will take effect after July 1st, 2027.

Forgiveness Changes

While not a change from the BBB, do note that the provision from the American Rescue Plan Act expired on January 1st, 2026. That means student loan forgiveness amounts are again subject to federal taxes. Forgiveness under the PSLF program remains exempt from federal income tax.

Undergraduate Changes:

Loans

Undergraduate student loans are not affected by the changes. Subsidized and unsubsidized loan limits remain the same.

Do note that Parent PLUS Loans now have caps. More information is available in the next section.

Pell Grants

These changes will be effective as of July 1st, 2026, in conjunction with the upcoming FAFSA form for the 2026-2027 academic year.

Some aspects of Pell Grants have expanded eligibility, such as:

- Expansion of Pell Grant for students enrolled in short-term job training programs at accredited institutions.

- Pell Grant eligibility has increased to any SAI less than two times the maximum Pell Grant amount. For example, those with an SAI of up to $14,790 will qualify for a Pell Grant in the 2026-2027 academic year up from $6,656 in 2025-2026.

Other aspects have limited eligibility, like:

- Students that already receive scholarships or other non-federal aid covering the full cost of attendance will not be eligible for Pell Grants

- Foreign income is now considered for adjusted gross income calculations

Parent Changes:

Updated Limits

Parent PLUS loans now have a new limit. Borrowers are limited to $20,000 per dependent, per academic year and a $65,000 lifetime limit per dependent student. Previously, it was only limited to the Cost of Attendance. This applies to all borrowers after June 30th, 2026.

Families of students who already borrowed one loan for the student's current academic program will be grandfathered into the limits for up to three years, or when their anticipated program length ends – whichever is shorter.

Grandfathering for Multiple Students

If I have two students, my first child enrolled from 2025-2029, and my second child from 2026-2030, will both be grandfathered into the limits if I borrow federal student loans for the first child?

No. Only for the student who borrowed a loan by the June 30th, 2026, will the deadline be grandfathered into the rules for three years. If your child has not completed their program by July 1, 2029, the new borrowing limits will take effect.

Income-Driven Plans

Incoming Parent PLUS borrowers will be ineligible for income-driven repayment plans, including the RAP plan. Current borrowers: see General Changes > Repayment Plans for more information.

Graduate and Professional Students:

Loans Phased Out:

The Graduate PLUS Loan program is being sunsetted effective July 1st, 2026. These loans historically had a higher interest rate, but allowed students to borrow beyond the unsubsidized loan limit up to the Cost of Attendance. Students who borrowed federal loans for their current graduate program prior to this point can continue to receive PLUS loans until their grandfathered limit.

New Loan Limits:

Please note that clarification is still required from the Department of Education regarding which programs are considered "graduate" and "professional." The latest proposal on this matter can be found here, but it is not yet ratified as of November 14, 2025.

Graduate Programs (e.g. Masters and Some PhD Programs)

$20,500 per year / $100,000 Aggregate Limit

Professional Programs (e.g.Medical & Law Students)

$50,000 per year / $200,000 Aggregate Limit

Attending a graduate and then a professional program later does not increase your borrowing limit. In total for the two programs, your cap would only be $200,000.

Loan Changes Cheat Sheet

| Graduated with loans BEFORE January 2026 | Borrowed First Loans BEFORE July 2026, but not yet graduated and will borrow after July 2026 | Borrowed First Loans AFTER July 2026 | Borrowed at least ONE loan DURING or AFTER 2027 | |

|---|---|---|---|---|

| Undergraduate Student |

|

|

|

|

| Graduate / Professional Student |

|

|||

| Parent |

|

|

|