The Complete Guide to

Student Loans for Law School

Getting into law school is difficult enough. Paying for it is another story. This guide will help break down your expenses, help you plan for, and understand the total cost of attending law school.

Congratulations on getting accepted to law school!

This is an awesome accomplishment that represents the culmination of years of hard work. Now, it’s time to set yourself up for success financially during law school and beyond, and avoid paying more money than you need to.

This guide walks you through the process of:

- Paying for law school – including how to find scholarships and grants

- How to negotiate your law school financial aid package.

- How to get the best loan that fits your needs, and

- How to restructure your loans after you graduate in order to save money and accomplish your goals.

Juno is here to help

We are on a mission to increase access to and reduce the financial burden of law school. Juno is a student-led initiative that utilizes the power of group buying to negotiate lower rates on private student loans and refinancing existing loans. We’re not a lender. Instead, we use collective bargaining to negotiate with lenders. People who sign up have no obligation to take our deals, nor do we ever charge our members.

Negotiating with lenders is easy when we’ve got thousands of members like you. We’ve done this successfully for a few years now, and have already saved students millions of dollars. It’s free to join, and if you do, you’re not committing to anything. We’ll just add your voice to our collective and let you know when we wrap up our negotiations, giving you the option to take the deal or go elsewhere.

We are also committed to helping students save money any way we can. We offer scholarships, loan information guides like this, scholarship databases, loans calculators, and more. Becoming financially informed on your student loan options is the first and best step you can take toward achieving your educational, professional, and financial goals.

Throughout this guide you will see ways that Juno can help you save money during law school. We will be completely transparent and always do our best to provide you with the information you need to make the best decision for your financial situation. Please reach out if you have any questions.

Before Borrowing Money:

Scholarships & Your Financial Aid Offer

The best way to minimize your student loan debt is to exhaust your other resources before borrowing. Before deciding which school to attend, it is important to consider the cost of attendance at your preferred school and the financial aid that they offer.

Many law schools have significant amounts of money to offer as scholarships to draw students to their school. Be sure to compare your offer and negotiate it before accepting your acceptance letter. Law schools want to remain ranked competitively so they will allow you to negotiate your scholarship offer (or lack thereof) with them if you can improve their ranking and add value to their incoming class. In these cases it helps to have offers from other similarly ranked schools that you can use as leverage.

💡 Check out Juno’s law school financial aid tracker to compare your offer to similarly situated students (those at your same school with a similar LSAT score and GPA).

1. Apply to several law schools

Consider applying to several law schools to have more options and leverage with your preferred school. The earlier in the application cycle that you apply, the better chances you have of acceptance and the better scholarship offer you will receive (some schools even offer special early decision scholarships, but they will require you to withdraw from consideration from other schools if accepted).

2. Explore scholarships from other sources

Some scholarships are only available to incoming students, but most are available for current students. Law firms and potential employers also frequently have large scholarships that you may qualify for and they often include an option to work for them as a summer associate. Check back regularly during law school and keep applying for scholarships.

💡 Check out our law school scholarship database to find scholarships that you qualify for. There are options for students in each year of law school (as well as other law programs).

3. Create a budget for each year that you borrow

Most law schools have an estimated cost of attendance that predicts what tuition, rent, textbooks, food, etc. will cost, but it is always a good idea to create a budget for your unique situation to know how much you need to borrow.

Don’t forget the cost of living and any employment you may have over the summer months, including when taking the bar and preparing to start your job in the fall after graduation. Many law school estimates do not take the summer months into account in their cost of attendance budget. Remember that although students are approved for a loan at the beginning of the school year, the loans are disbursed in two installments each school year: at the beginning of the fall and spring semesters, and you can plan your borrowing accordingly.

Finally, it is important to consider what employment opportunities will be available after you graduate from the law school you are considering. Depending on the rank of your law school and your performance, your employment opportunities and expected salary may change significantly. Carefully consider your ability to repay loans before deciding what school to attend, what type of loan to use, and how much to borrow.

Student Loan Fundamentals

Before deciding how you are going to finance your legal education, it is important to understand the student loan fundamentals. If you feel that you are familiar with these concepts, feel free to skip down to Two Types of Student Loans: Federal & Private. Otherwise, keep reading below.

When choosing which loan is right for you, there are a few key factors to consider:

- Interest Rates. A student loan interest rate is the percentage of money that your loan accrues as a borrowing cost each year that must be paid back over time. The interest rate is stated as an annual percentage, but the interest actually accrues every day. When it comes to the actual interest rates, don’t assume that all lenders’ rates are the same. Some lenders offer better pricing than others and you can take steps to lower your rate.

💡 We pool large groups of students and graduates together to get a volume discount on loan interest rates. By getting multiple lenders to compete for your business, everyone in the group gets a lower interest rate than they could get by themself.

There are two types of interest rates: fixed and variable. At Juno, our partners allow you to choose from competitive Variable and Fixed Rate options.

- Fixed Interest Rates are locked in for the life of the loan. They are often slightly higher than what initial variable interest rates offer, but they are predictable and will not go up with market fluctuations. The only way to change a fixed interest rate is through student loan refinancing, and many students choose to refinance when the fixed rates drop. For these reasons, the majority of students choose a fixed rate loan.

- Variable Interest Rates are subject to change throughout the life of the loan. Student loan lenders typically set variable rates based on an economic indicator known as the London Interbank Offered Rate (LIBOR). Lenders determine variable rates by adding the LIBOR rate to a base rate (which is determined by your credit score). When the LIBOR changes each month, your rate goes up or down accordingly which changes your monthly payment. While the variable interest rate may be cheaper on the day of your application, you should consider your personal tolerance for the risk that it could go up or down over the years.

Be aware of Capitalized Interest.

Capitalized Interest is unpaid interest that's added to your student loan, increasing the total you repay. Each month that you have an unsubsidized loan or don’t pay your interest, additional interest accrues. The following month’s interest will then charge interest on both the principal and interest from the previous month. For that reason, whenever it is possible you will save money by at least making your interest payment each month.

- Fees. All student loan lenders do not charge the same fees. Some lenders may charge:

- Application Fees: A fee charged by a lender to apply for the loan.

- Origination Fees: A fee charged by a lender when you first take out a loan.

- Prepayment Penalties: A prepayment penalty is a fee you'll have to pay if you pay back your loan ahead of the predetermined schedule.

No application fees, no origination fees, and no prepayment penalties with Juno.

We screen our partner lenders and push them to eliminate all fees. We do not accept unless they ensure that they do not charge any of these fees.

Important terminology

Repayment Term:

How long you have to repay your loan varies by the repayment plan you choose. The repayment term represents how many years of monthly payments you must make in order to completely pay off your loan. Shorter repayment terms have lower interest rates and allow you to repay your loan faster. This allows you to pay less total money, but also requires larger monthly payments. The standard repayment term is 10 years, but lenders also often have options for 5, 7, 15, and 20 years.

Repayment Plan:

No matter which repayment plan you choose, interest will start to accumulate on your loans as soon as they are dispersed. There are four common repayment plans for private student loans, although not all lenders offer all of them

- Immediate Repayment: Under this plan students make full monthly payments while in school. This saves money, but is not realistic for most students.

- Interest-Only Repayment: This permits students to make payments on the interest that accrues each month. That way, when you graduate, interest will not have accrued and you will not owe more than you borrowed.

- Partial Interest Repayment: Students can also choose to make a fixed monthly payment that covers only part of your loan interest. This slows how fast your loan balance grows while in school.

- Full Deferment: This plan lets you defer any payments until after you graduate; however, your loan balance will grow the entire time.

The biggest decisions when it comes to choosing a repayment option are:

- Whether you want to make payments while you are in school or defer repayment until you graduate.

- How much you want your monthly payments to be while you are in school.

Note that:

- It may be better to borrow less money up front rather than to use a portion of your student loans to pay towards interest. Money you earn while a student can go towards payments.

- Making in-school payments helps reduce the overall cost of the loan as you start paying down interest sooner. Some lenders will give you more options than others.

At Juno, our partners allow you to choose from a wide variety of repayment options:

- Fully Deferred (or no payments in school)

- Flat (or monthly payments in school)

- Interest Only (or interest payments in school)

- Full Repayment In School (or principal and interest payments in school)

- Auto Pay Discounts. Many, but not all lenders, will offer an Auto Pay Discount. An Auto Pay Discount reduces your interest rate when you set up your account to make payments using automatic payments from your bank account. Juno partners offer these.

📝 Reminder: The Auto Pay Discount usually only applies when you have payments due. If you select a repayment plan which defers payments while you are in school, the auto pay discount only begins once you’ve graduated and begin making payments. For this reason, if you can afford to make the minimal interest payments each month under the flat repayment plan then you can save money by lowering your interest rate even more. - Special Discounts. Some lenders will offer unique opportunities to reduce your interest rate even further. For example, you may see a “relationship discount”. A relationship discount can reduce your interest rate for using additional products or services offered by the same lender (for example a credit card, auto, or home loan). The discount you get for being a Juno member is typically considered to be in this category.

- Cosigners. A co-signer is a person who is obligated to pay back the loan just as you, the borrower, are obligated to pay. It could be your spouse, a parent, guardian, or a friend. They only have to pay anything if you default on your loan—they’re typically just the backup plan. A cosigner who has a good credit score and a regular source of income is best.

Juno pays close attention to the makeup of our borrowers and if they have co-signers or not. Based on that, we negotiate the option for our borrowers not to have a co-signer.

Two Types of Student Loans:

Federal & Private

Once you know how much money you need to borrow and understand the student loan fundamentals, the next step is to consider what type of loan you will get.

Federal Student Loans

Federal student loans are offered by the federal government, whereas private student loans are offered by private lenders.

- While there are many types of federal student loans, U.S. Citizens and eligible non-citizens pursuing their JD, LLM, or MSL (or any law program) can typically access Direct Subsidized Loans (undergrads only) Direct Unsubsidized Loans and Direct PLUS loans (also known as the Grad PLUS loans, only available to graduate students). Most applicants qualify, regardless of credit score.

- All federal student loan interest rates and fees are set by Congress on July 1st of each year and remain fixed for the life of the loan. Students who need financial aid apply for loans each academic year (usually dispersed before the start of each semester) and rates differ from academic year to year. That means that when you graduate, each loan for each year of school likely has a different interest rate. Federal loans come with a standard repayment schedule and offer a wide range of repayment assistance options.

- Direct Unsubsidized Loans are more affordable (they have better interest rates and origination fees) than Direct PLUS Loans; however, law students are only able to use the Direct Unsubsidized loans for the first $20,500 they need to borrow each year. Direct PLUS Loans are utilized for any amount beyond that. Direct Unsubsidized Loans do not require a certain credit score to qualify whereas Direct PLUS Loans do; however, the credit requirement is quite low and most all students exceed it.

- → Why is it called a Direct “Unsubsidized” loan? These loans are called “unsubsidized” because the federal government does not pay the interest while you are in school, it begins to accumulate right away and will capitalize unless interest payments are made. This is in contrast to Direct Subsidized Loans, which are available to undergraduate students, and have the benefit of federal government subsidized interest payments until six months after you graduate or drop below half-time enrollment in college. Direct Subsidized Loans have the same balance the day you get them as the day you graduate.

- For loans disbursed after July 1st 2025 & before July 1st 2026, the interest rates and fees are:

| Direct Unsubsidized Loans | Direct PLUS Loans Graduated Students Only |

|

| Maximum Loan Amount | $20,500 | Up to Cost of Attendance minus other aid received |

| Interest Rate | 7.94% | 8.94% |

| Origination Fee* | 1.062% | 4.228% |

*Origination fees vary slightly based on when you take out your loan in the school year. The fee is updated every year for loans disbursed on or after October 1st, meaning that if you borrow the same amount of money each semester, your origination fee will likely be different.

What’s an origination fee?

Origination fees are one time fees – basically a processing fee for signing up with the lender. Essentially, you have to borrow $10,106 before interest to receive $10,000 for school through a Direct Unsubsidized Loan. And you have to borrow $10,424 to receive $10,000 for school through a Direct PLUS Loan. The original loan balance plus the origination fee becomes your new principal balance that interest begins accumulating on. That means that interest begins accumulating on $10,424 right right away.

The fees become even larger when you account for the cost of a typical year of law school. For example, if you borrowed $70,000 to pay for a year of school the origination fees for the first $20,500 under a Direct Unsubsidized Loan would be $332 and the fees for remaining balance under a Direct PLUS Loan would be $2,103 for a grand total of of $2,435 in origination fees.

To apply for federal student loans, students must complete the Free Application for Federal Student Aid (FAFSA).

💡 Juno members never pay origination fees on any of their private loans. That’s potentially thousands of dollars saved.

How are the federal loan interest rates set?

All federal student loan rates are set by Congress, which passes the interest rates set by the Department of Education into law each year. The rates are based on 10-year Treasury notes, plus a fixed increase.

Student loan rates are set in the spring and are effective from July 1 to June 30 of the upcoming school year. To ensure interest rates don’t rise too high, Congress also includes rate caps for each type of student loan.

The formula used for different types of loans, from the Congressional Budget Office (CBO), is as follows:

- Direct unsubsidized loans for undergraduates: 10-year Treasury + 2.05%, capped at 8.25%

- Direct unsubsidized loans for graduates: 10-year Treasury + 3.60%, capped at 9.50%

- Direct PLUS loans: 10-year Treasury + 4.60%, capped at 10.50%

Based on the above formula, undergraduate students pay the least to borrow for college. Parents and graduate students will usually pay more to finance educational costs.

Federal Student Loan Options for Lawyers

Once a law student graduates with federal loans, they have a 6-month grace period before payments are due. During this time, the federal government automatically enrolls you into the Standard Repayment Plan (a 10-year repayment plan with fixed monthly payments). Under this plan, you pay the same amount during your first year out of law school as you do 10 years later. This is the same repayment plan (at a higher interest rate) that a borrower with private loans might have. If you feel that you cannot afford to make your monthly payment, the federal government allows you to opt into an Income Driven Repayment Plan which may lower your payment.

Income-Driven Repayment (IDR) Plans

IDR plans can benefit lawyers in the public or private sector who have a low income relative to their loan amount (public interest lawyers must also be on an IDR plan to qualify for PSLF, see below). Most federal loans qualify, including Direct Unsubsidized Loans and Direct PLUS Loans made to grad students. For a full list of eligible federal loans, see the federal student aid eligibility website.

Anyone can apply, but IDR plans set your monthly student loan payment at an amount that is intended to be affordable based on your income, family size, state of residence, and tax status, so if your income is too high relative to your family size it will not change your monthly payment. You need to fill out an application to see what you qualify for. The federal government also has a loan simulator that you can use to help choose which plan, if any, you qualify for and which would be best for you.

Currently, there are 4 different IDR plans:

- Revised Pay as You Earn Repayment Plan (REPAYE Plan)

- Payment amount = generally 10 percent of your discretionary income

- Repayment period = 25 years if any loans you’re repaying under the plan were received for graduate or professional study

- Pay as You Earn Repayment Plan (PAYE Plan)

- Payment amount = generally 10 percent of your discretionary income, but never more than the 10-year Standard Repayment Plan amount

- Repayment period = 20 years

- Income-Based Repayment Plan (IBR Plan)

- Payment amount = generally 10 percent of your discretionary income if you're a new borrower on or after July 1, 2014, but never more than the 10-year Standard Repayment Plan amount

- Repayment period = 20 years if you’re a new borrower on or after July 1, 2014

- This plan is also the most commonly used of the four plans

- Income-Contingent Repayment Plan (ICR Plan)

- Payment amount = the lesser of a) 20 percent of your discretionary income or b) what you would pay on a repayment plan with a fixed payment over the course of 12 years, adjusted according to your income

- Repayment period = 25 years

*Under all four plans, any remaining loan balance may be forgiven if your federal student loans aren't fully repaid at the end of the stated repayment period. For any Income-Driven Repayment Plan, periods of economic hardship deferment, periods of repayment under certain other repayment plans, and periods when your required payment is zero will count toward your total repayment period.

Whether you will have a balance left to be forgiven at the end of your repayment period depends on a number of factors, such as how quickly your income rises and how large your income is relative to your debt. Because of these factors, you may fully repay your loan before the end of your repayment period and not receive any loan forgiveness. In these situations you pay higher interest for the life of your loan, and more money than you would with private loans, but do not receive any forgiveness benefits.

All federal loans are assigned a loan service provider—a company that the federal government assigns to handle the billing and other services on your federal student loan on our behalf, at no cost to you.Your loan servicer will track your qualifying monthly payments and years of repayment and will notify you when you are getting close to the point when you would qualify for forgiveness of any remaining loan balance. For this reason, it’s important to stay in contact with the loan service provider that the federal government assigns your loan to.

Although there are benefits to an IDR plan, there are also disadvantages.

- If you have several years of low income after graduation, your monthly payment may not cover the interest on your loans and you will experience negative amortization. This means that the balance owed on your loan each month is actually going up.

- If your income increases enough relative to your family size, your monthly bill will increase to the Standard Repayment Plan amount, meaning that your loan will be paid off in ten years at the most. Therefore you may not have any loan balance left to forgive when the 25 year IDR plan limit is up. In fact, you may have lower payments each month over a longer period of time, but may end up paying significantly more money that you would have under the standard plan (and almost certainly more than if you had refinanced with private loans, see below).

- You may be required to pay income tax on any amount that’s forgiven if you still have a remaining balance at the end of your repayment period. That is why it is especially harmful to experience negative amortization. This tax rule applies under current IRS rules, which may change.

Public Service Loan Forgiveness

For law graduates that go to work at certain public or non-profit jobs, there are additional benefits to federal loans available. The Public Service Loan Forgiveness Program (PSLF) forgives the remaining balance on federal loans on an Income-Driven Repayment Plan once you have made 120 qualifying payments while working for a qualified employer (10 years worth of payments instead of the 25 normally required under an IDR plan). This program began in 2007, so the first loan applications for PSLF began coming up in 2017.

In order to have your loan forgiven, you need to make sure that you fulfill all the necessary requirements year after year. Unfortunately, many applicants make payments without recognizing that they failed to fulfill a requirement and the payment is not counted towards PSLF. The requirements can be difficult to fulfill—in fact, as of February 2021 only about 1% of borrowers who have applied for PSLF have had their loans discharged. These numbers are expected to improve in the coming years as borrowers become more familiar with the requirements, but the program is definitely not a sure bet.

In addition, policy changes can result in the program no longer being intact. There is a good chance that applicants that have already made payments could be grandfathered in if the program were to end, but there is no guarantee and applicants should be aware of the risk.

The necessary requirements for PSLF include:

- Qualifying Employment. Qualifying employment for the PSLF Program isn’t about the specific job that you do for your employer. Instead, it’s about who your employer is. Employment with the following types of organizations qualifies for PSLF:

- Government organizations at any level (U.S. federal, state, local, or tribal)

- Not-for-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code

- Serving as a full-time AmeriCorps or Peace Corps volunteer

- Full Time Employment. You are generally expected to work for your employer’s definition of “full time” or 30 hours per week, whichever is greater, in order for your payment to count.

- Eligible Loans. Direct Unsubsidized Loans and Direct PLUS Loans qualify for PSLF. These loans are consolidated into a Direct Consolidation Loan. Private loans are NOT eligible for PSLF. In addition, other federal loans such as the Federal Family Education Loan (FFEL) Program and the Federal Perkins Loan Program (which was discontinued in 2017) are not eligible unless consolidated into a Direct Consolidation Loan.

- Qualifying Payments. Payments are considered “qualifying” if they are made:

- after Oct. 1, 2007;

- under a qualifying repayment plan;

- for the full amount due as shown on your bill;

- no later than 15 days after your due date; and

- while you are employed full-time by a qualifying employer.

- *Your 120 qualifying monthly payments don’t need to be consecutive. For example, if you have a period of employment with a non-qualifying employer, you will not lose credit for prior qualifying payments you made.

- Qualifying payments are only allowed during periods when you’re required to make a payment. Therefore, payments made during these periods do not qualify:

- in-school status,

- the grace period,

- a deferment, or

- a forbearance.

- Qualifying Repayment Plans. You must use an income-driven repayment (IDR) plan (plans that base your monthly payment on your income, see above) to benefit from PSLF.

- Before you change to an IDR plan, however, you should understand that your payment may increase under these plans depending on your income and the amount that you owe.

- Some applicants also can earn too much money later in their public service career so that they no longer qualify for an IDR plan and therefore cannot qualify for PSLF. Carefully consider these limits before relying on PSLF.

*In order to make sure that you fulfill all of these requirements, you should submit a Public Service Loan Forgiveness: Employment Certification Form annually or when you change employers.

Deferment or Forbearance

If you fall into short-term financial trouble, you may also qualify for a deferment or forbearance under both federal and private loans; however, the options are often more extensive for federal loans. Under either of these options, your monthly student loan payment is temporarily suspended but interest often continues to accrue and capitalize.

Deferment: You must apply in order to get a deferment and cannot stop payments until approved without becoming delinquent. For federal loans, qualifying situations include: cancer treatment, economic hardship, a graduate fellowship, in-school deferment, military service and post-active duty student, rehabilitation training, and unemployment. Some deferment plans suspend interest capitalization as well, but most don’t.

Forbearance: Similar to deferment, this is a period during which your monthly loan payments are temporarily suspended or reduced due to certain types of financial hardships. The federal government assigns your loan to a specific lender, and you must reach out to them directly to request forbearance. If granted, principal payments are postponed but interest continues to accrue. Unpaid interest that accrues during the forbearance will be added to the principal balance (capitalized) on your loans, increasing the total amount you owe.

Often when you experience more than a temporary setback, you may want to enroll in an Income-Driven Repayment Plan instead as it would likely save you more money.

In some extreme circumstances the federal government can grant administrative forbearance which allows you to temporarily stop making monthly loan payments. For example, due to the COVID-19 national emergency, federal loans will have 0% interest accruing and no payment collections from March 20th, 2020 until September 30th, 2021. Federal borrowers can still make payments during this time if they wanted to lower their loan balance, but it was not required. Regardless of what borrowers chose to do, all months during this period still qualify for PSLF. Private loans had some similar options, but they varied by lender.

Loan Repayment Assistance Programs (LRAPs)

In addition to having your law school student loan debt forgiven, there are several opportunities to have your student loan payments subsidized by Loan Repayment Assistance Programs (LRAPs). These programs are generally designated for students in the public interest sector, government, or other low-paying legal fields. They are offered by law schools, bar associations, federal and state governments, and some employers in the form of a forgivable loan that helps you repay your education debt. Most LRAPs cap the amount of money that a graduate can earn in their field to qualify and contain requirements for certain years of work in those sectors to qualify.

Some providers limit LRAPs to federal loans, but most accept private loans as well. Currently LRAPs are considered taxable income, yet they still save you money if you qualify. Just remember the tax bill at the end of the year.

Cost Benefit Analysis

As always, there is a tradeoff between the benefits of federal loans and the extra cost they impose. If you have good credit, going with private loan options could save you thousands of dollars in interest and origination fees, though you will lose some federal loan repayment protections.

However, if you think that you might work for the government or a public interest group, you want the security and protections associated with federal loans. For that reason, many of Juno’s law student members wait until the end of their 2L summer before accepting a private loan. At that point they usually know what their job will be after graduation, how much they will make, and what areas of law they want to pursue and can plan their loans accordingly. That way, only one year of law school is funded by private loans and their loans from the previous two years still have the federal protections. Then, after they graduate and start their full time job, law graduates can then decide whether to refinance and save money on monthly and cumulative payments, or continue paying more for the benefits of federal loans.

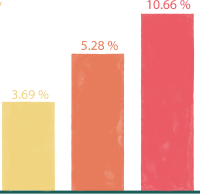

It is also important to put numbers to your decision so you can understand how much of a difference a private loan interest rate with Juno could make. Take, for example, someone borrowing $70K a year to pay for their JD in the 2019-2020 academic year (the average loan volume in the Juno dataset).

A qualified borrower with good credit could save ~$15,635 over the life of a 10-year loan. Those savings add up to about $130 every month for 10 years, without taking into account that you may be able to pay off your loans faster if you spent the savings on early payments.

In summary, the decision of whether to accept a federal or private loan is an important personal decision with important financial consequences. It is clear that to make that decision students and alumni must first understand their options. For that reason we recommend that all law students, graduates, and alumni sign up with Juno to have access to a lower interest rate and to understand your costs. Signing up is free (and always will be) and there is no obligation to take a loan. It simply helps you understand what your options are. We genuinely want you to make the best financial decision for you and your family and will never recommend that you take a loan that is not best for you.

Private Student Loans

Private student loans are offered by private banks and lenders. These loans are available to fund law school upfront and can be used to refinance both private and federal loans after graduation. To apply for these loans, students must apply directly through the various lender websites.

How are private loan interest rates set? Every private lender has their own unique underwriting process and standards for student loan applicants; these eligibility requirements help lenders decide whether to give an applicant a loan, and at what interest rate. As part of the loan application process, lenders will require a credit check to evaluate your ability to repay and how risky you are. If you have a credit score in the high 600s you will likely qualify for a loan, and the higher your score is the better rate you will be offered. Keep track of your credit score in the months leading up to applying for a loan and take steps to raise your score if possible.

→ How can I know my credit score? There are several sites where you can go to check your credit score for free. These sites also have recommendations on how to improve and monitor your score.

In order to lower your rate even more or improve your chances of getting accepted, lenders will allow you to add a cosigner. You can get a loan without a cosigner especially if you’ve got a good credit score, but the amount of time you’ve held an account (like a credit card) is one of the factors in calculating a credit score so a good one takes time to develop.

Many law students also choose to refinance their student loans after they graduate and start full-time work because they will get a significantly lower interest rate than they had in school. You normally need to have three paychecks from your new job in order to qualify.

💡 We also pool together recent graduates and alumni who are looking to refinance their loans. Sign up and join the pool to have access to a lower rate than you could get by yourself. The more people who join the negotiation pool, the more money everyone saves – it’s a volume discount.

After you submit an application and receive approval for a private student loan, you typically will be presented with multiple options such as:

- Variable or Fixed Interest rates

- Loan Term (also known as Repayment Term)

- Repayment Plan

*See the Student Loan Fundamentals section for more information about each of these options

In addition, you will see the interest rates offered to you as well as any fees associated with the loan. It’s important to understand what you’re choosing between. The following sections will help you understand any student loan options presented to you.

→ Why Do Private Loans Have a Lower Rate?

Federal student loans generally do not screen creditworthiness (or the ability to repay), whereas private student loans include a more rigorous credit review to determine the borrower’s anticipated ability to pay. Even for Direct PLUS Loans, which do require a credit check, the necessary score required to get a loan is quite low. Therefore, the federal government has to price loan interest rates at a level that takes into account the risk profile of everyone they lend to. As a result, those with good credit scores often receive better rates from the private market.

Additionally, and most importantly, there are benefits unique to the federal program such as Income Driven Repayment Plans and Public Service Loan Forgiveness. The disadvantage is that these programs come at a cost—they require higher interest rates which cause you to spend significantly more money than you otherwise would. Some federal borrowers end up paying for benefits that they never receive, and in turn end up subsidizing the benefits of others.

Essentially federal loans are a form of insurance that gives you protections in certain situations—just like car insurance or insurance on a cell phone. Before determining whether you want to pay for this insurance via higher interest rates, be sure to understand the programs that follow.

💡 Featured Aside: If you have a good credit score (650+), private student loans can often offer lower interest rates and fees than federal loan options. Always compare your options to ensure you're getting the best deal.

The Private Student Loan Process

Normally, it is best practice to start the application process at least 30 days before your program’s tuition due date. That being said, some students are able to get through the entire process within a week.

Here are the steps involved:

- Apply and check your rates on the lender’s website

- You’ll enter your personal information, school information, and your requested loan amount in order to apply for a loan.

- Many lenders will give you a preliminary rate estimate without pulling a hard credit check.

- Get your approval decision (Instant to 3 days)

- Once you’ve reviewed the initial rate estimates, you can submit your application. This will kick off a hard credit check which allows lenders to, among other factors, determine whether to approve you for the loan and what your rates will be.

- Some lenders have an instant process, while others require a manual check which can take a few days.

- The result will come back with one of 3 results: approved, denied, or eligible with a creditworthy co-signer.

- Accept and sign your loan terms

- If you are approved, your next step is to choose your loan terms and accept the loan.

- This is where you are able to choose between variable and fixed interest rates, and different repayment options (loan term and in-school payment plans). You’ll sign the remaining documents to confirm the terms and conditions.

- Wait for school certification

- The rest of the process generally occurs between the lender and your school (unless there are any issues you need to be notified about).

- During certification, the school approves your enrollment status, anticipated graduation date, and loan amount requested compared to your cost of attendance (COA). Schools can either certify the loan as is, or request changes based on the student’s status.

- The process takes between 1 day to 2 weeks, but could take longer depending on how early you apply (some schools won’t start certifying until tuition bills officially come out) and your school’s certification process. We recommend calling your financial aid office for guidance.

- Your funds are disbursed

- Loan disbursement is how your school receives the funds to pay for your education. Typically, the lender sends funds directly to your school, they are not sent to you.

- For most schools the disbursements will be sent once per semester, if you applied to cover more than one term. Universities set their own disbursement dates, which are normally around the beginning of the semester.

- Any loan amount you have requested above the cost of tuition would be transferred to you by the school. This is commonly known as a “refund” back to you and can be used for things like rent, living expenses, and textbooks.

- Repaying your student loans

- Payments for your loan are made through your chosen lender’s portal. Depending on the repayment plan you have chosen, you may need to start making payments as soon as you start school (in-school payments) or you may not need to make any payments until after you graduate (deferred payments).

Federal or Private,

What’s the Difference?

There are pros and cons to both federal and private loans. At its most fundamental level, federal loans offer a type of “insurance”—protections that exist to help you with payments in the future if you don’t make enough money to make your monthly payments. However, this insurance comes at a significant cost in the form of higher interest rates. In order to make an informed decision, it is important to understand your unique circumstances and future employment expectations, as well as what benefits federal loans could offer you. Only then will you be in a position where you can make an educated decision about what is best for you.

The following chart summarizes the advantages and disadvantages explained in further detail below.

Federal Loans

| Advantages | Disadvantages |

|

|

Private Loans

| Advantages | Disadvantages |

|

|

| Federal Loans | Private Loans | |

| Advantages |

|

|

| Disadvantages |

|

|

FAQs

We hope this guide has equipped you with enough knowledge to make an informed decision about your student loans. We are an initiative founded by students and we are here to help students make the best student loan financial decisions for their unique situation.

If you have any questions that weren’t answered here, drop us a note at hello@joinjuno.com and let us know. We’d be happy to help.

To learn more about the student loan offers Juno has negotiated, visit https://joinjuno.com

How do Juno negotiated rates compare to Federal Loans?

In the 2025-2026 school year, Federal loans for Graduate students were:

- 7.94% + ~1% origination fee for the first 20.5K

- 8.94% + ~4.2% origination fee for anything above that

Many of our members will get:

- ~7.5% + 0% origination fee for the entire amount

The difference amounts to thousands of dollars depending on the size of your loan.

What’s the timeline?

We collect names and emails all year round. In May we start negotiating and in June we release our negotiated deal. Folks usually have a few months to decide whether they’d like to take it – there is no obligation to do so.

Who can participate?

JD, LLM, and MSL students can join our negotiation pool — in fact any student can participate for free. Juno (and the private student loan market in general) will very likely get you a better interest rate than federal loans, which are not subsidized for grad students. If you've got a good credit score (650+) you should absolutely consider all of your options before taking a Federal loan.

That said, you’ll also want to evaluate whether you’ll need perks offered by federal loans such as income-based repayment plans and public service loan forgiveness.

For that reason, many law students sign up at the end of their 2L year when they know that they will be going to a law firm and not a public interest job. After graduating and beginning their full time job, new attorneys also refinance through Juno to get even lower rates.

Why do lenders participate?

Banks spend a great deal of money on marketing to find customers. By showing up directly, all of those marketing dollars saved end up translating to money in your pocket. Plus, lenders are getting a bunch of loans that they wouldn’t be seeing otherwise.

How do you make money?

We charge lenders a fee. It’s set before the formal auction, so companies can’t sway us by offering more money. The only way to become an official partner is by offering our members the best rates.

How do I use Juno instead of Federal loans while I am in school?

First, sign up with Juno to join our negotiation pool. It’s always free and you never have to take a loan. Second, once we negotiate with lenders, we will notify you of your lower interest rate loan offer and you will have some time to decide whether to accept it. Third, if you choose to take the loan, notify your financial aid office and the lender will send your tuition there directly. The remaining balance will then be refunded to you for cost of living expenses.

What if I already applied for and was approved for a federal loan?

Before school begins, and even 120 days after your federal loan is disbursed, you have the option to switch to a private loan with a lower rate with Juno. Simply notify your financial aid office that you want to make the switch. You can also see our webpage on switching loan providers.

When should I refinance my existing loans?

After you graduate and get a full time job, you are eligible to refinance both federal and private student loans. Your rate will be even lower once you are employed.

Can I refinance without a job?

Most lenders will require proof of employment, such as an offer letter or pay stub. Part of the reason you’re able to reduce the loan interest rate through refinancing is due to the fact that you have a steady income, which lenders look for before adjusting your payments.

Should I refinance all of my student loans at the same time?

You can! Many of our members choose to refinance based off of whether their rates will be reduced or the time to repay is better.

Do I need to fill out multiple refinancing applications if I have multiple loans?

No. You only need to do one application even if you have multiple loans.

You really won’t spam me or sell my information?

No, we won’t. We will only send you emails to update you on the status of our negotiations. You can choose to get emails about scholarships or other resources, but you never have to. We do not sell your information to anyone.

How Does Juno Work?

We gather large groups of students who need help paying for school and get lenders to compete for our business. Undergraduate students, graduate students, and alumni looking to refinance their student loans are all eligible to join our negotiation pool. Here’s how it works:

Step 1. You sign up.

Sign up for free and tell us a little bit about yourself and the type of student loan you need. It takes less than one minute and we don’t run a credit check. Once you've joined, encourage your friends to sign up as well. The larger the group grows, the more everyone can save.

Step 2. We run a bid.

We run a bidding process between banks, credit unions, and other lenders. They compete for our collective business by offering exclusive discounts. By negotiating on behalf of a large group, we can get loan rates that are lower than any individual member could get by themself.

Step 3. We compare.

We compare all offers, negotiate terms, and select a single winner for the group. We share the negotiated deal with you and you can decide to use it or not. There’s no commitment.