Refinancing for Medical

Professionals

Reduce your existing student loan debt, plus receive a bonus on top.

Hi, I’m Dr. Chinedu Okafor

Hi, I’m Dr. Chinedu Okafor, Head of Medical Partnerships at Juno — and someone who has walked in your shoes. After earning my neuroscience degree at Dartmouth, a Master’s in Biomedical Sciences at Tufts, and my MD from Duke, I completed an Orthopaedic Surgery internship at the University of Pennsylvania. Along the way, I co-founded a nonprofit to support underserved pre-med students on their path to medical school.

I know firsthand the pressures of medical training and the burden of student debt. That’s why I’m committed to helping fellow physicians and healthcare professionals secure a stronger financial future.

By harnessing the power of collective bargaining through Juno, we can push for better interest rates and more manageable monthly payments — freeing you to focus on patient care and the career you’ve worked so hard to build.

Connect: (339) 330-4147

Schedule: From Monday to Saturday

Looking to run some numbers?

We've got you covered with some helpful tools.

Summary

Student loan refinancing is common, especially for people with private student loans, with an estimated 50,000 professionals doing so each month. It involves taking out a new student loan to pay off the existing debt you have, lowering your rate and overall cost.

Compare your options

There’s no one size fits all for student loan refinance – that’s why it’s important to shop around and see your options. Most of our picks allow you to see rates in less than 10 minutes with a soft credit check, so you can get customized quotes without affecting your credit score.

For medical professionals

Almost there!

Just enter your email to get a copy of this guide.

How it Works

Step 1.

Fill our quick form

It will take less than 2 mins and signing up doesn’t commit you to anything. We’ll just make sure you get the best deal.

Step 2.

Visit our partner

We’ll provide a special URL to redeem the Juno deal. You’ll visit the lender site to get the credit check. Usually it’s an instant approval if you’re eligible.

Step 3.

Complete the refinance

If you like your refinance offer, you can accept for free. Your new lender will pay off your old debt. You'll begin making payments on your new loan.

How we keep more money in your pocket

Lenders spend so much money on marketing. In comparison, 80%+ of our members find out about us from a friend.

We pitch lenders an alternative. Give our members better deals and avoid spending thousands of dollars per customer on marketing. It saves them time and money, and we end up getting our community better rates and cash back for free.

Our Journey

Our founders Nikhil and Chris started Juno a few years ago when they were shopping around

for loans for Harvard Business School. Since then, they’ve been immersed in the student loan

industry, regularly speaking with key players nationwide and researching the market.

Every year, we make all the lenders compete to offer the best deals to our community.

In the process, we pore over dozens of rate tables, and stay up all night crunching

spreadsheets to map out which lenders offered the most people the best rates. Through this data analysis, we're confident that our choices are the best for the community.

Since Juno members never pay us, we charge all lenders a set fee that is

agreed before the negotiations begin. That way, we can’t be swayed by a larger financial

incentive. The only way to be featured on our site is to offer our community the best deal.

The Power of Numbers

$1,217,951+

in cash back earned by our community

237,000+

members

$1B+

in loans

Hear from a member!

“I was with Sallie Mae and my interest rate was 10.75%, but I refinanced through [Juno] and not only got my rate down to almost 4%, but I also got $1000 cash.I got paid. To save money.So make sure as soon as you graduate and get your first paystub to refi.

It's super easy and literally takes under 10 minutes, the hardest part is typing in how much you have saved in all our accounts to prove assets as well as entering your social.Their system literally automates all the hard parts out of it. Not everyone will save as much as me because I'm kind of an extreme case.I refinanced 170k at 10.75%V to 4.04%F, cutting my monthly payment from $2800 to $1250.

This is totally free and you can still write off payments on your taxes. Hope this helps someone...Of course, make sure you do plenty of research and ask tons of questions to the lender before you refinance any debt.I applied for refi literally everywhere and this was the best deal by like 1.2% and was much easier to fill out the app than at other places.”

Josh C.

Georgia Institute of Technology

Can I refinance?

While we don’t determine eligibility (our lending partners do) there are some basics that are usually needed.

At least $5,000 in student loan debt

No bankruptcies or defaults

Attended a Title IV-accredited non-profit school

Credit score above 650

Employed with a steady income in USD

U.S Citizen or possess a 10-year (non-conditional) Permanent Resident Card

Note that while most lenders require a completed degree, one of our partners Earnest now has an option if you did not graduate. The last attending date needs to be longer than 6 years ago, and your credit needs to be above 700.

Looking for customized rates?

Get them in less than 5 minutes by just answering:

Your name and email address

Your citizenship status

Degree, school and graduation date

Credit score above 650

Student loan balance

Income

Rent/mortgage payment

Address

FAQs

Who is refinancing for?

There’s little downside associated with refinance, and a large potential upside in terms of savings, and reducing your monthly payment. You’re free to refinance whichever assortment of loans you choose without being forced to refinance all at once.

Note that you may lose benefits associated with your underlying federal and/or private loans if you refinance such as federal Income-driven Repayment Plans, Economic Hardship Deferment, Public Service Loan Forgiveness, or other determent and forbearance options common with federal loans. If you file for bankruptcy, you may still be required to pay back this loan.

That said, you should always consult a financial advisor before taking any action. This article is not intended to be financial advice, and we urge you to do your own research independently.

What happens when you refinance?

Usually after people refinance a loan, we hear “why was that so easy?” The truth is that the process is fairly straightforward.

On a basic level, you’re taking out a new loan to pay off your old loan.

Since you’re employed and are perceived as ‘less risky’, your new loan ideally has a lower interest rate, saving you money in the long run.

Why does the term refinance still give me the willies?

The likely culprit: home mortgage refinance – between closing costs, cash-out refinancing that involves moving other debt around, and potential loss of protections, this cousin of student loan refinance gives all refinance a bad rep.

In contrast, student loan refi through Juno doesn’t have any fees involved, and is basically a straight 1:1 refinance – that means you can only get a new loan covering the cost of your existing student debt.

That means that you can’t borrow more than what you already owe. Student loan refi typically doesn’t involve collateral, unlike home mortgage refi where your house can be foreclosed on if you don’t pay your mortgage bills.

As always, please consult a financial advisor for additional context.

Remember, refinancing private student loan debt typically doesn’t result in the loss of protections; refinancing federal student loan debt can result in the loss of certain protections (income-driven repayment, forbearance options, etc).

You can always pick and choose what you’d like to refinance without affecting all your loans.

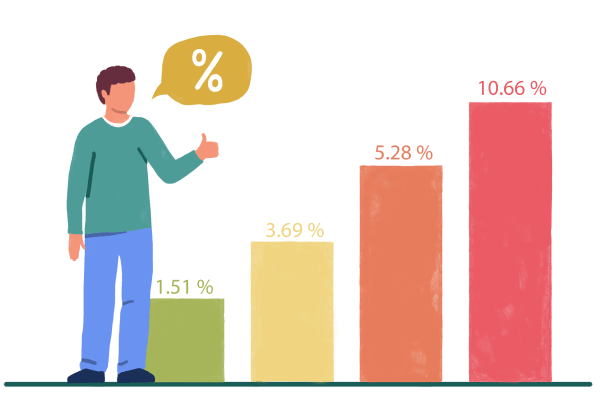

Is now a good time to refinance private student loans?

Rates hit historic lows back in November 2021, and started going back up since then. Given more likely upcoming rate hikes (as of October 2023), we think now is a decent time to get in before they go up even more. Plus, don’t forget that you have the option to refinance multiple times. Some of our members refinance their loans once a year if they can get a better rate.

What about Parent PLUS loans?

Yes! All of our partners allow you to refinance Parent PLUS loans. Sometimes people want to change the name of the loan holder. Depending on the partner, it may be possible to refinance the loan into your child’s name. Individual results may vary.

With Earnest, you can only refinance loans already in your name as the primary borrower. If your parent is the primary borrower, the original lender may be able to transfer the loan from the parent to you, and then Earnest can refinance in your name.

It is possible to refinance a Parent PLUS loan into your child’s name with SoFi, but your child must apply. Please contact their Customer Support to learn more.

Laurel Road does allow you to refinance a Parent PLUS directly into your name.

Featured Articles

Got questions?

Drop us a line at hello@joinjuno.com.