Improving Your Credit

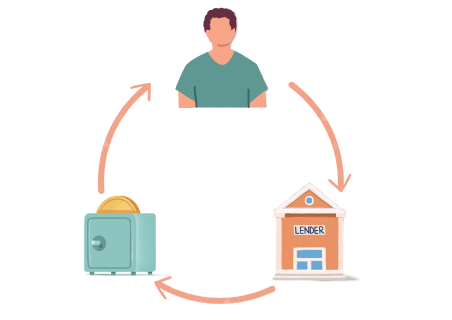

One of the smartest things you can do in preparation for taking out a student loan is to improve your credit score. Your FICO is one of the variables lenders use to decide how expensive your loan will be. Typically the higher your score, the lower your loan costs.

You can boost your credit in 3 to 6 months by exploring a few different tools.

What Is Good Credit?

When you’re researching auto loans, mortgages, or private student loans, you’ll likely see that lenders typically require borrowers to have good to excellent credit to qualify for a loan. But what exactly does that mean?

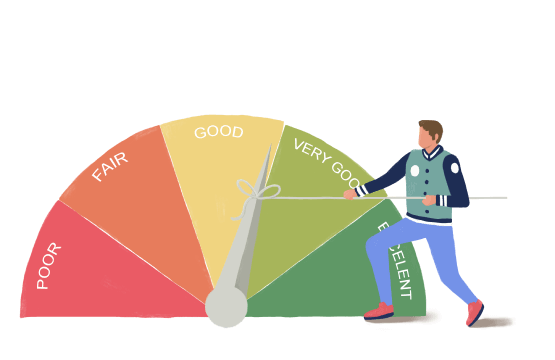

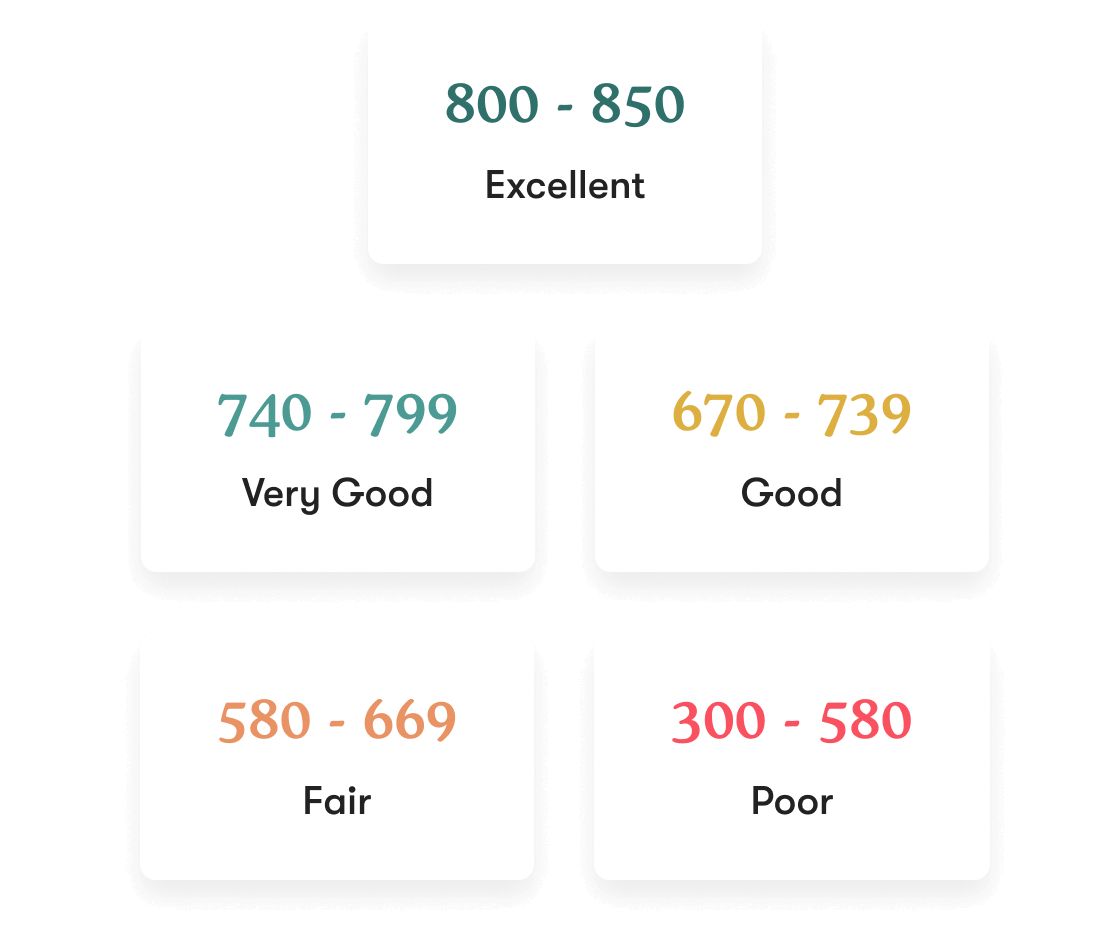

While there are many different credit scores, the FICO is one of the most common and widely used. By evaluating your past history with debt, FICO issues you a score. FICO scores range from 300 to 850:

To have good credit, you need a score of 670 or higher. The better your credit score, the more likely it is that you’ll qualify for credit cards and loans and get a low interest rate.

Factors That Affect Your Credit Score

To determine your credit score, FICO looks at several different variables:

- Payment history: Your payment history makes up 35% of your score. FICO looks at how often you make your payments on time. If you’ve had late payments in the past, that can dramatically lower your credit score.

- Amounts owed: How much you owe, also known as your credit utilization, affects 30% of your score. Lenders like to see that you don’t max out your credit cards or take out large loan balances.

- Length of history: In general, lenders like borrowers that have longer credit histories since it gives them a more accurate picture of the individual’s habits. When you’re young, the length of your history can be quite short; the length of your credit history makes up 15% of your score.

- New credit: When you apply for multiple forms of new credit, such as student loans and a car loan within a few weeks, it makes lender’s nervous. They worry you’ve overburdened and won’t be able to keep up with your payments. Your new credit makes up 10% of your score

- Credit mix: Ideally, you’ll have multiple forms of credit on your report, such as installment loans and credit cards. Being able to juggle a mix of credit types proves you’re a more responsible borrower. Your credit mix accounts for 10% of your score.

How Long Does It Take to Build Credit?

According to Experian — one of the three major credit reporting agencies — it can take three to six months to establish a credit history or improve your credit. If you’re starting completely from scratch, it may take longer, but you can generally see significant improvements within six months.

But how long does it take to get a 800 credit score?

While scores of 800 and above are considered excellent and highly sought after, it can be difficult to achieve a score that high. It can take several years of on-time payments and paying down your balances to reach that score.

We’re here to help!

You can email us at hello@joinjuno.com or call us at (339) 330-4147 with any questions