Variable Rates

How do variable rates work?

Variable Interest Rates can change throughout the life of your loan.

When you get a variable student loan quote, it is structured as SOFR + Spread.

- SOFR (Secured Overnight Financing Rates) is a standard short-term secured rate calculated daily. It's the rate the market is willing to lend using Treasury securities as collateral for one day.

- Spread is the amount above SOFR that the lender charges you for your loan, based on your credit score and other risk factors. This is a fixed number and does not change.

The only thing that changes the cost of your variable rate loan is changes to the SOFR. Monthly payments under this type of rate are not constant. Payments will decrease when the SOFR goes down and will increase when it rises.

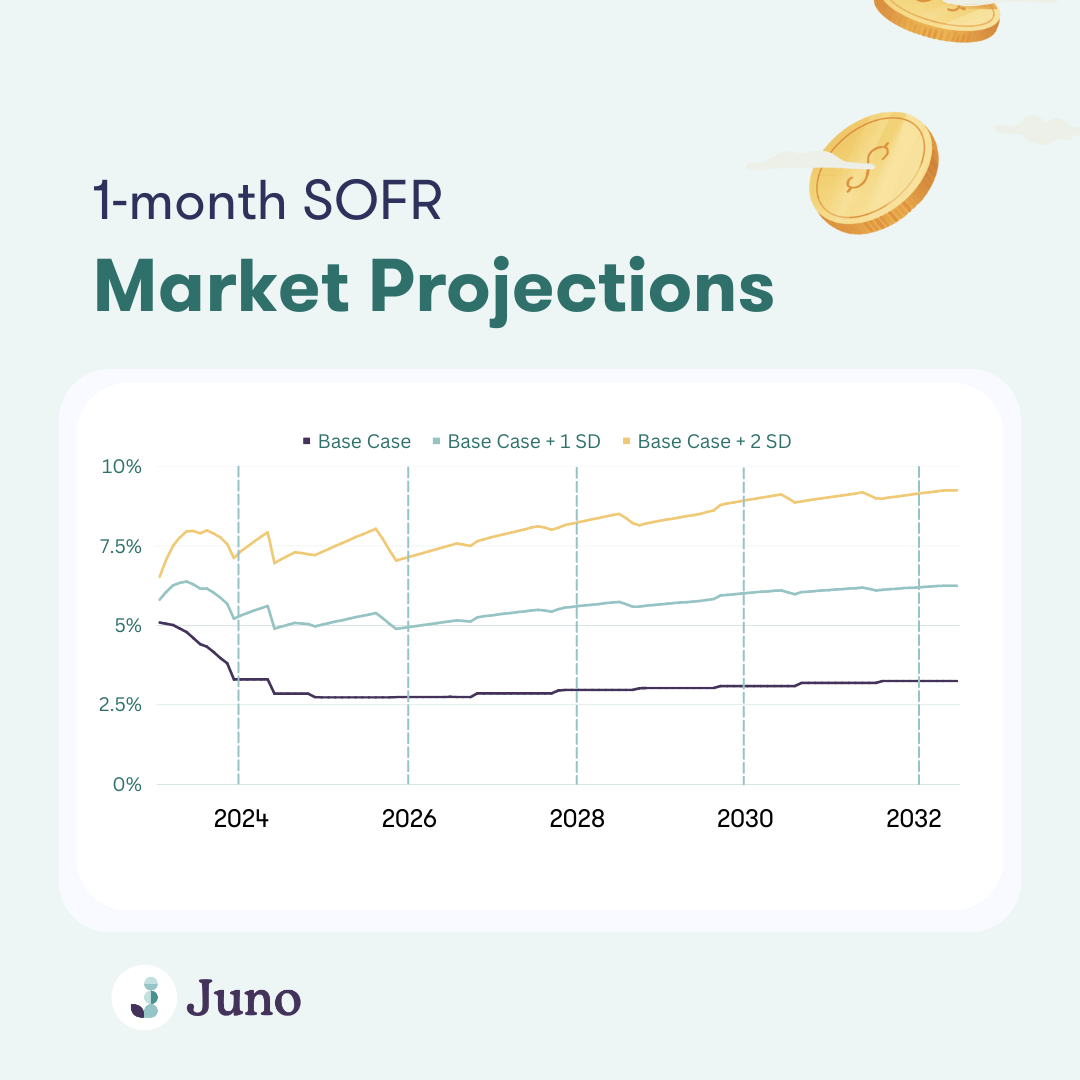

Below is a chart from 05/09/2023. It shows the market’s projection for how 1-Month SOFR will change over the next decade.

In our calculator

- “Base Case” is the “Market Projections” line below

- “Aggressive” case is 1 Standard Deviation higher than the median expected outcome

- “Very Aggressive” case is 2 Standard Deviations higher than the median expected outcome

Does this mean that we should get a Variable Rate Loan?

First off –we're not financial advisors and therefore, this content should solely be viewed as educational and not prescriptive. Please consult a licensed professional.

Taking a variable loan is taking some additional risk. If rates go down, your payment can decrease, but the contrary is true; if rates go up, you are also on the hook for higher payments.

In addition, the market has been wrong in the past. As an example, in a past version of this graph, the market didn't expect rates to rise as aggressively as they did.

A final point is that most people refinance their loans after graduation. If you get a fixed-rate loan now and rates decrease in the future, you can benefit from the lower-rate environment by refinancing. If you get a variable-rate loan, and rates go up, you won’t be able to get the same benefit.

When thinking about variable vs fixed, we would encourage you to think of the following:

- What are my refinancing opportunities? If you are a domestic student, you will likely have more options, or if you are going to work in a traditional career after graduation vs a nontraditional path.

- How risk-averse are you? If you prefer to know your exact payment after school, probably a fixed rate is the best option for you.

- What’s the difference between your variable rate quotes and fixed rate quotes? If you are not getting a big discount for taking variable rates now, it may not be worth it. Again, remember that if you expect rates to decline in the future, you will likely have the option to refinance once you graduate.

Notes

To project the SOFR rate into the future we used Pensford SOFR Forward Curve Calculator, which takes the “baked in” implied rates for the SOFR in the future.

In practice, SOFR could be different than the market implied rate.