Why The Internet is Full Of Wrong Parent PLUS Calculators

There are plenty of Parent PLUS loan calculators on the internet, but a lot of them are incorrect. Read why that is in this article.

When you search “cost of parent PLUS loan,” you’re probably getting a half baked answer. The sad truth is that most of the top results for calculators don’t tell the full story, and as a result are misleading.

The main problem with most Parent PLUS calculators is that they assume you start repaying the loan immediately, when most people don’t.

If you don’t make that assumption the total cost of the loan is much higher. In our example below, the difference between the Juno calculator and a NerdWallet calculator is $16,910. Let’s dig into it further.

What are Parent PLUS Loans?

Parent PLUS loans are federal loans offered to parents of dependent undergraduate students by the US Department of Education. These loans are offered to any biological or adoptive parents who pass a credit check and meet general requirements for federal student aid.

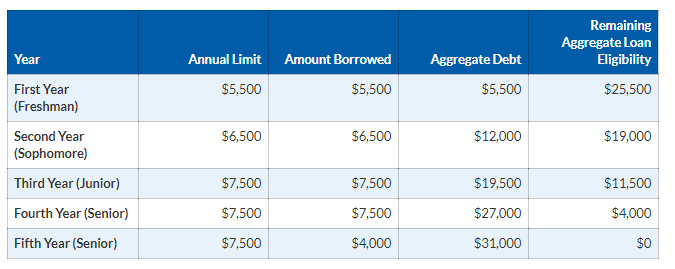

Hundreds of thousands of families file for parent PLUS loans each year. These loans are typically used once a family hits their federal lending limit to cover their remaining charges. Parent PLUS loans are also federal loans, but they’re capped at the cost of a student’s attendance rather than a predetermined amount.

Direct Undergraduate Loans Lending Cap

The problem with Parent PLUS calculators

Parent PLUS loans do not require immediate repayment. Many parents request a deferment while their child is enrolled at least half-time in school, which means they do not make payments until 6-months after their child graduates. According to a poll run by Juno, 64% of respondents opted to wait until after graduation to begin repaying. This option allows parents time to save and prepare for repayment, but interest accrues on parent PLUS loans, adding a significant expense to a family’s debt.

Parent PLUS calculators are tools that parents can use to estimate how much they will have to repay over the lifetime of a loan. However, most of these calculators assume that parents will immediately start their repayment plan. This assumption can significantly underestimate the total cost a parent will have to pay.

For instance, among the class of 2019, the average Parent PLUS loan was $37,200. With the current Parent PLUS interest rate level (6.284%), if a parent chooses to defer their payments until 6 months after their child graduates on a $37,200 loan and their child has 4 years left in school, they will have racked up $10,519.42 in accrued interest. Remember, when someone takes a $37,200 loan, the school actually only receives $35,691 due to the 4.23% origination fee. The total financing cost of the loan will be $14,195.16 higher than if a parent chose to immediately make their monthly payments, given a 10-year loan term. This figure would not be included in the estimate provided by most online calculators.

Provider | ||||||

Total Calculated Cost | 67,100.00 | 50,190.00 | 50,190.00 | 53,925.00 | 52,598.83 | 52,406.32 |

Notes | We assume you won’t start paying back the loan immediately | Assumes immediate repayment | Wrong interest rate provided on website | Uses 7.9% as annual interest rate | Assumes incorrectly an autopay discount for Parent PLUS | Last year’s rate provided on website, minimum payment of $50 |

*$37,200 loan, 6.28% interest, 4.228% fee, repayment of 10 years, first year student (4 years + 6 months deferment)

These calculators can be quite misleading and can prevent parents from properly managing finances to work towards their repayment plan. Our calculator at Juno accounts for the interest accrual from the deferment period of 6-months post graduation, which provides a much more accurate estimate of what a parent will actually have to pay over the lifetime of a Parent PLUS loan. Come take a look at our calculator here.

Looking at your private options

After hitting the federal lending cap of Direct loans, we recommend that families with good credit consider private loans instead of Parent PLUS loans. Parent PLUS loans have a much higher interest rate and origination fee than private loans -- some private loans don’t have any origination fees. For Parent PLUS loans disbursed on or after July 1, 2021, and before July 1, 2022, the fixed interest rate is 6.284%.

This year, Juno’s partner is offering the lowest rates on private loans. After reaching out to 250+ banks and credit unions and comparing their bids, we selected one lender whose rates blew the others out of the water. As a Juno member, you will get lower rates than if you went directly to the lender yourself, for free!

If you want to directly compare Parent PLUS loans to private loan options, including our negotiated deal, our Parent PLUS calculator allows you to do so.

Make an informed decision

With higher interest rates and significant interest accrual during periods of non-payment, Parent PLUS loans are costly and can cause families to go into large amounts of debt.

Take the Schweizer family, for instance. As reported by The New York Times recently, in 2005, the Schweizer family began taking out Parent PLUS loans each academic year. The Schweizers repeatedly deferred their payments and consolidated their loans, resulting in high interest accrual. Today, they owe the federal government half a million dollars.

Consider looking at your private loan options before applying for Parent PLUS loans. It may be easier to get a Parent PLUS loan if you have a low credit score, but those with good FICO (650+) should definitely evaluate a private loan.

Written By

Juno Team

Juno came into existence to help students save money on student loans and other financial products through group buying power by negotiating with lenders. The Juno Team has worked with 200,000+ students and families to help them save money.