In Exclusive Partnership With

College is one of the biggest financial decisions you'll ever make.

Road2College

partners with Juno to give its students access to free tools and resources that help you maximize your aid and find better rates on student loans.

Need a loan right now?

We've got an option from last year's group you can use. Check it out!

How it Works

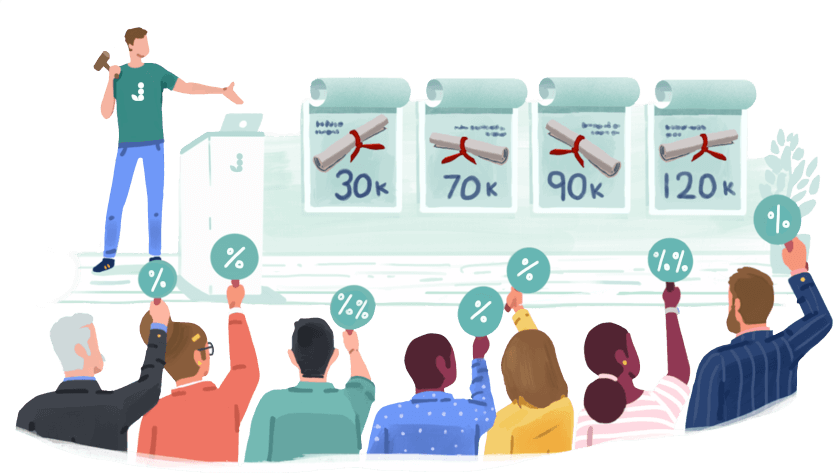

We gather groups of students and get top lenders to give us bulk discounts.

ALL YEAR

You sign up.

Tell us a little bit about yourself and help us grow our negotiating power by spreading the word.

MAY

We run a bid.

Using the power of your voices, we make lenders compete for our collective business. New Juno members are still welcome during this time!

JUNE

We share.

We share the negotiated deals with you and you can decide to use it or not.

There’s no commitment.

How we save you money

Through the power of 245,961+ members

Our collective voices hold so much strength at the negotiating table. Thanks to this, whenever we talk to lenders, we have a ton of leverage to get our community better deals.

Lenders want our collective business

Financial institutions want to lend money. More volume, even if the volume is getting a better deal, is better for them. And better rates is better for you. It’s a rare win win.

Our Journey

We’re committed to saving students money

Our founders Nikhil and Chris started Juno in 2018 when they were shopping around for loans for Harvard Business School.

They gathered a group of 700 people who needed loans together. Then, they got a dozen lenders to bid on the rates they would offer to members of the group.

They realized that lenders are willing to offer discounts to large, diverse groups that they would not otherwise offer to individuals.

Now, we’re running another round of negotiations for fall 2026!

Free, Fast and Easy

Signing up is free and takes less than 2 minutes. We don’t run a credit check and don’t need your social security number.

Better Deals

Months of research and the competitive process ensure that our members get the best rates in the market. You’re always free to compare yourself!

Together

Invite those you care about and help the negotiation be successful. The larger the group, the better our chances of success. You'll also get rewarded for helping grow our community.

Transparent

We will keep you informed through the entire process so you can make informed decisions.

FAQs

Can I apply at any point of the year and get the same rates?

Can I increase the loan amount later?

How does Juno make money?

To clarify, we receive compensation from the financial services companies appearing on this page.

What is the disbursement timing?

Got questions?

Drop us a line at hello@joinjuno.com.