What’s the Average Interest Rate on Student Loans?

Knowing the average student loan rates can help you understand how your predicted rates compare. This article will help you understand a good idea of rates.

If you're considering borrowing for school, or if you already have educational debt, you may be curious about the average student loan interest rate. Interest is the cost paid to borrow and the higher the rate the more repayment will cost each month and over the life of the loan.

So, what is the average interest rate for student loan debt? New America, a non-partisan think tank, reported that the national average interest rate across all educational loans was 5.8% in 2017.

While this may be the overall student loan average interest rate, there's a little more to the story since calculating a single average rate isn't the best way to estimate what your loans will cost you. That's because there are different kinds of student loans and the average private student loan interest rate differs from the federal one. Interest rates can also change from year to year, so the current year's average rate is different from the historical one.

The best way to know if you're being offered a fair rate for your student loans is to compare quotes from several lenders, providing your own financial information so you can get a rate tailored to you. This can give you a more accurate estimate of borrowing costs than looking at the student loan average interest rate.

Still, if you're curious, here's what you need to know about average rates.

Average student loan interest rate for federal student loans

According to EducationData.org, the average federal student loan interest rate since 2006 is 6.05%. However, this paints a somewhat misleading picture, as there can be big differences depending on the type of federal aid. Federal student loans all come with low fixed interest rates -- but the exact fixed rate varies by type.

Each year, borrowers taking out the same type of loan will pay the same rate regardless of their credit score or their income. There's no need to look at an average interest rate for student loan debt if you're trying to figure out what loans will cost you personally -- instead, you should find out the current interest rate available for your loan type.

For federal loans issued by the U.S. Department of Education between 7/1/22 and 6/30/23, here's what those rates looked like:

- For Direct Subsidized Loans and Subsidized Stafford loans for undergraduate students: 4.99%

- For direct Unsubsidized Loans and Unsubsidized Stafford loans for undergrads: 4.99%

- For Direct Unsubsidized and Unsubsidized Stafford loans for graduate students and professional students: 6.54%

- For Direct PLUS Loans for parents and grad students or professional borrowers: 7.54%

Since there's no variation in federal student loans, every borrower getting a particular type of loan will know exactly what rate they'll be charged.

Historical average federal student loan rates

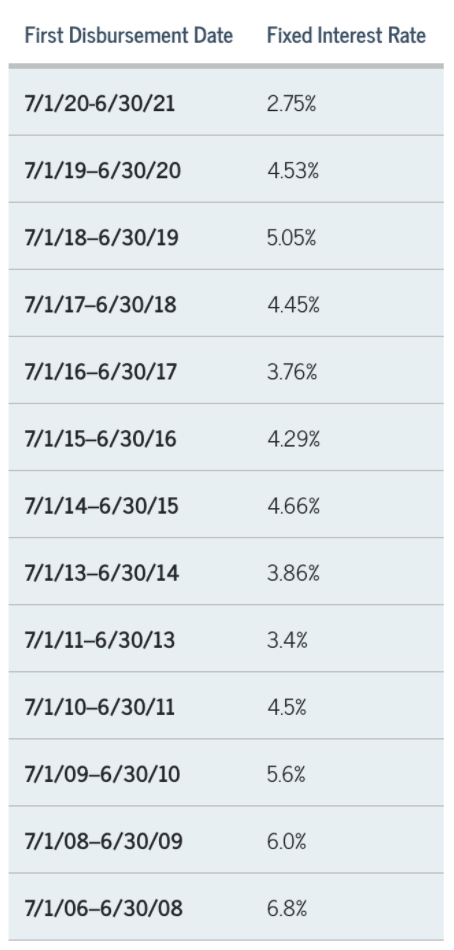

Some borrowers may not just be interested in the current average rates, but may be curious about the answer to the question, what is the average student loan rate over time? Again, this depends on the type of loan you're taking out. Here are the historical rates for Direct Subsidized Loans and Subsidized Federal Stafford Loans. If you take a look at this chart, you can see, for example, that the average rate for this type of loan over the past five years was 4.108%.

You can do this type of calculation with each of the different kinds of loans for which the Department of Education has made historical data available.

Average private student loan interest rate

It's a lot more complicated to answer the question, what is the average student loan interest rate when you're talking about private student loans. That's because individual lenders set their own rates based on the borrower's credit score and profile as well as market conditions.

Education Data reports that the overall average private student loan rate varies between 6% and 7%. However, some borrowers could qualify for rates as low as 1.04% while others might pay as much as 12.99% or more for their loans.

Unfortunately, many borrowers with private loans are paying more interest than they need to. In fact, Education Data reported on a study that if every eligible borrower were to take advantage of student loan refinancing, the national average interest rate would fall to 4.2%. According to New America, an estimated 52.8% of households who currently have student loan debt could reduce their interest rate if they refinanced their loans.

That said, with federal student loan rates on the rise over the past few years, private student loan options may be more competitive once again.

Can you lower the interest rate on your student loans?

If you are in the process of taking out student loans, you should generally aim to exhaust eligibility for federal Direct Loans first. These tend to have lower rates and better borrower repayment benefits and protections than private loan options. Borrowers may be able to take advantage of deferment/forbearance, grace periods, income-driven repayment plans, and student loan forgiveness options too.

If you've maxed out your loans from the federal government, shop around among different private lenders to get the most competitive rate. You should also consider asking a cosigner to apply with you, as this can often help you get a better loan offer.

If you already have student loans, refinancing could potentially help drop your rate and reduce your total interest costs. You likely don't want to refinance federal loans and give up the unique benefits they offer, but there's no downside to refinancing private loans if you can qualify for a new loan at a lower rate than your current one is charging.

Juno can help you to find the most competitive rates on private loans as well as on private student loan refinance loans. We get groups of borrowers together and negotiate with lenders on their behalf to help them save.

Written By

Christy Rakoczy Bieber

Christy Rakoczy Bieber is a full-time personal finance and legal writer. She is a graduate of UCLA School of Law and the University of Rochester. Christy was previously a college teacher with experience writing textbooks and serving as a subject matter expert.