We use group buying power to negotiate better student loan rates.

Join us, no committment needed.

- Free for you - How?

- It takes <1 minute to join

- No hard credit check

Deals we think you'd love

Undergraduate loans

For undergrads who’ve hit the caps on Federally Held Student Loans. Our deal is usually better than Parent PLUS for those with 650+ credit & has no origination fee.

View DetailsGraduate loans

A good alternative to Federal Loans for people with good credit or a co-signer. We guarantee the lowest student loan interest rates on the private market.

View DetailsRefinance loans

Lower your existing student loans by converting them into a new loan with a better interest rate. Best for people with a steady income. Depending on borrower location & occupation, we’ll recommend the best option. Most deals feature a signing bonus or a rate reduction.

View DetailsHealth Insurance for Internationals

For international folks studying in America looking to save money on health insurance.

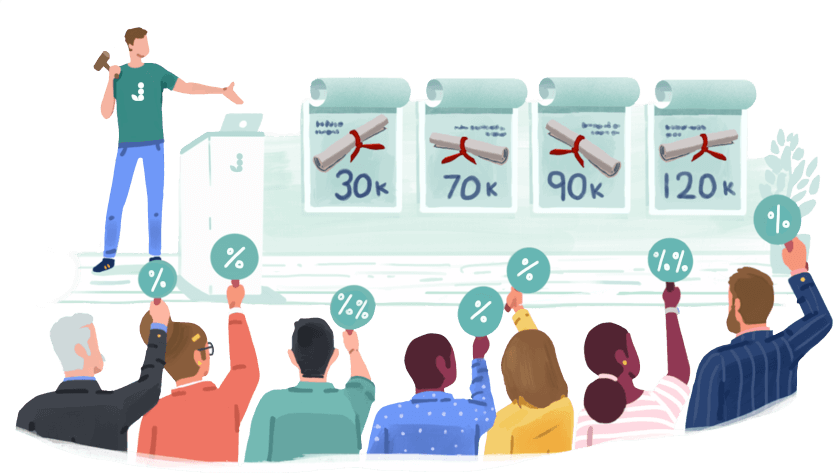

View DetailsHow it Works

We gather large groups of people and get lenders to compete for our business.

You and your friends sign up.

Sign up for free and tell us a little bit about yourself.

We run a bid.

We run a bidding process between banks, credit unions, and other companies. They compete for our collective business by offering exclusive discounts and rewards.

You get the lowest rates!

We compare all offers, negotiate terms, and select the best options for the group. We share the negotiated deals with you and you can decide to use it or not. There’s no commitment.

Summary (TL;DR)

Join us for free to access exclusive discounts that save you more money than if you went

to our partner directly, from rate discounts on student loans to the best

cash back deals on refinancing!

We negotiate exclusive deals with our lending partners. Some of our deals feature interest

rate discounts while some feature cash back bonuses. (What does cash back mean? Think of it

like a signing bonus– when you sign with one of our partners, you can get paid by the lender,

us, or both.) Either way, you'll save money, and

you won’t get these deals anywhere else.

Our Journey

We started Juno a few years ago when we were shopping around for loans for Harvard Business

School. Since then, we’ve been immersed in the student loan industry, regularly speaking

with key players nationwide.

This year, we ran an auction, making all the lenders offer the best rates to our community.

In the process, we pored over dozens of rate tables, and stayed up all night crunching

spreadsheets to map out which lenders offered the most people the best rates.

Since members of the community never pay us, we charge all lenders a set fee that is

agreed before the negotiations begin. That way, we can’t be swayed by a larger financial

incentive. The only way to win the auction is to offer our community the best rate.

Our Track Record

Juno is the only organization that has successfully negotiated discounts for student loans on behalf of large, diverse groups of students. We’ve helped students and families borrow more than $1B+ at discounted rates. Additionally, our cash back deals have given more than $1,217,951+ back to our members. Over 212,969+ members have trusted Juno to negotiate more affordable student loans for them.

By the numbers

- 212,969+ members

- Hundreds of referral rewards paid out to our community

- Millions in savings

How we save you money

Lenders spend lots of money on marketing. In comparison, 80%+ of our members find out about us from a friend.

Instead, we pitch lenders an alternative: give our members better rates and avoid spending

thousands of dollars per customer on marketing. It saves them time and money, and we end up

getting our community better rates for free.

Who is this for?

If you’re currently an undergraduate student, we have a student loan deal with an exclusive

rate discount that can help you bridge the gap after you’ve hit the federal lending limit. You don't need to stick with Sallie Mae or Parent PLUS loans.

If you’re currently a graduate student, we have a negotiated student loan deal just for you. You can easily compare your options against the federal rates and see how much

you can save with

our comprehensive calculator.

If you’ve graduated and have student loans, refinancing is great for people with high

interest student loans, especially private. For private loan borrowers, there’s little

downside associated with refinance, and a large potential upside in terms of savings,

such as reducing your monthly payment.

If you’re an international student, we have some

student loan and refinancing options for you, along with tools to ensure you know about all your options.

Got questions?

Drop us a line at hello@joinjuno.com.